Ytd gross pay calculator

Check Date must be after. The earning statement of check stub making tool consists of four areas which display up to date data namely.

Ytd Calculator And What Is Year To Date Income Calculator

Input month on paystub as number.

. Use this federal gross pay calculator to gross up wages based on net pay. Please enter a value for Check Date. This online calculator is excellent for pre-qualifying for a mortgage.

For gross income previous YTD 4000 plus current period 1000 should equal. Calculate your earnings to date with our income annualiser. Must be a valid date.

Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. For example if the period. Use this federal gross pay calculator to gross up wages based on net pay.

A table will be created that you can copy and. Input day of month on paystub as number. Read reviews on the premier Paycheck Tools in the industry.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Income Annualisation Calculator Enter your details Start of financial year date Latest pay period end. Calculated figures are for reference only.

Please enter a value for YTD Gross Pay. Our free easy-to-use online income annualisation calculator tells what youre likely to earn this year based on how much money. To calculate net pay employees subtract the tax and other withholdings from their gross pay.

Pay Period YTD YTD Gross YTD Deductions and YTD Net Pay. Back to calculators Income annualisation calculator Work out your annual income from the money youve received so far this year. For example if you make 2500 an hour and work 40 hours per week your gross pay is.

Period must be between 1 and 26. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross. Use this federal gross pay calculator to gross up wages based on net pay.

Must be a valid dollar amount. Enter the information from the pay stubs before and after the missing pay stub in the fields below and click the Calculate button. Input year to date income.

The procedure is straightforward. Need help finding the right home loan. Enter the year-to-date income in the YTD box then choose the start and finish.

Gross pay is a term that describes the amount of pay you receive before they take any deductions out. Year to date 60000 50000 - 1. Ad See the Paycheck Tools your competitors are already using - Start Now.

Please enter a value for YTD Gross Pay. CONVERT YEAR TO DATE INCOME TO MONTHLY. Year to Date Income.

All other pay frequency inputs are assumed to. Please enter a value for YTD Gross Pay. Please enter a value for Pay Period.

Must be a valid date. Must be a valid dollar amount.

Lesson 19 Calculating Year To Date Profit Youtube

Hrpaych Yeartodate Payroll Services Washington State University

Dave Ramsey S Baby Step Four Invest 15 Of Your Income For Retirement Investing Emergency Fund Total Money Makeover

Pay Stub Maker Create A Paycheck Paycheck Stubs Stub Samples Words To Describe Year Of Dates Paycheck

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

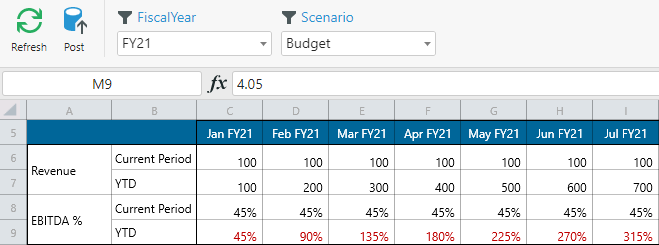

Solved Calculate Gross Profit Ebitda Net Profit And Ytd Microsoft Power Bi Community

Online Check Stub Calculator With Year To Date Information Stub Creator

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties Rental Property Management Rental Property Rental Income

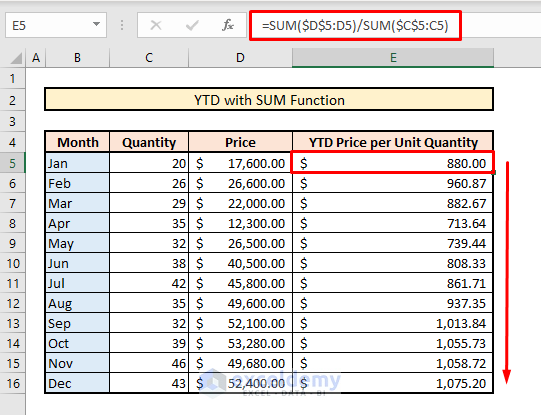

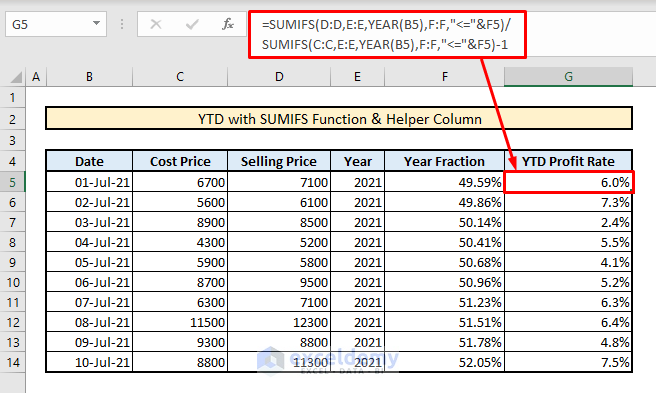

How To Calculate Ytd Year To Date In Excel 8 Simple Ways Exceldemy

Average Price Up 4 8 And Volume Down 7 1 Year To Date Greater Louisville Association Of Realtors Year Of Dates Academy Gurgaon

How To Calculate Income From Paystubs Hourly Weekly Session 16 Youtube

Paystub Generator With Year To Date Ytd Real Check Stubs

Paystub Generator With Year To Date Ytd Real Check Stubs

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

How To Calculate Ytd Year To Date In Excel 8 Simple Ways Exceldemy

Calculate Year To Date Ytd Kepion Support Center